During our recent webinar, UAG Director David Cooper gave an overview of current market performance as we start to move past the peak of the pandemic, potential recoveries and how to manage your investments during uncertainty.

Below are the key takeaways.

Current equity market performance*

All major equity markets have taken a significant hit due to the coronavirus pandemic. Each of those markets, however, are showing slightly different recoveries.

For example, the FTSE is facing greater challenges with the added uncertainty of Brexit weighing on its recovery while the Dow Jones has shown signs of bouncing back. All equities in the Dow Jones are typically back up between 1% and 2%.

We witnessed equities hitting rock-bottom in mid–late March when oil fell to $0 per barrel. However, we’ve since seen the biggest rally since the 1930s Depression.

For people who want to increase their savings or put more investments in their programs, there is definitely an opportunity in equities.

*(as at 7 May 2020)

How different sectors have been impacted

Some core service sectors such as education, package holidays, hotels, restaurants and catering, are more vulnerable because of social distancing rules and staff being furloughed.

In the US, education will be significantly impacted due to the potential loss of fees from international students who are more profitable to the economy than US students. How the US manages this impact in the future will be critical, to their economy and their reputation.

In the UK, spending on package holidays is taking a major hit given the likelihood of many UK holidaymakers not being able to leave the country for their annual summer holidays. Such an impact will be even more dramatic in countries such as Spain.

It remains to be seen if this gap in spending will be covered by residents taking their holidays in their home countries rather than visiting family and friends in neighbouring European countries.

Policy and fiscal responses to the situation

Countries around the world have had to fight back with significant policy and fiscal measures to address the impacts we’ve witnessed.

For perspective, let’s reflect on what happened at the end of the 2008 Global Financial Crisis (GFC). The GFC is the most comparable situation with what we’re now experiencing.

At the end of the GFC, every major central bank came up with a methodology of economic stimulus that hadn’t been used since the 1930s. They literally printed money: a total of $7 billion in the US. In the simplest terms, it was like playing Monopoly with your family and, while taking a break in the game, the banker borrowed money from their own bank.

While in 2008 the Central Bank of America was printing money, the European Central Bank took a different route: they adopted austerity measures to cut public spending and pay down debt.

If we compare the two different strategies, the US response – known as quantitative easing – won the day. Even though it cost the US $7.8 trillion, it was more effective than austerity because money was circulating to support businesses.

The Euro Zone had since adopted similar quantitative easing measures before the COVID-19 coronavirus pandemic. Due to the pandemic, the US is doing the same thing again.

Various central banks have all adopted similar measures in their policy and fiscal responses to support business in the aftermath of the pandemic. For example:

- In the USA, $2 trillion has been put forward for big blue-chip businesses (e.g. Boeing) and $480 billion for small and medium-sized businesses.

- In Japan, the Prime Minister has offered unlimited support to keep businesses afloat and people employed, despite their country being behind on the curve of the virus.

- In Europe, there are more challenges as 27 nations need to agree the approach; however, there is talk of COVID bonds and Germany has announced a support package of €780 billion.

Nearly every country has been affected by the pandemic. We can’t hide from it nor its impacts. Close to 40 million people are currently either out of work or have been furloughed in Europe with more than 20 million claiming unemployment in the US. However, it’s reassuring to see governments doing what they can to support businesses and workers.

Sector performance – the winners and losers

During any market collapse there are winners and losers.

The obvious winners in ecommerce include Amazon (up approximately 35% YTD), Alibaba in China and Zoom. In Big Pharma, Johnson & Johnson have made big wins due to the increased sales of paracetamol, while Roche is manufacturing testing kits at an increasingly rapid rate. Netflix of course is another company that has seen phenomenal growth on the back of millions of people being confined at home for long periods of time.

Across every sector there are big losses. Boeing, Virgin Atlantic and Virgin Blue are obvious losers due to the grounding of flights while leading oil companies have taken a big hit to profits. In related industries, Booking.com and Hertz have been significantly impacted. High-street retailers who rely on foot traffic, such as Primark, have suffered the effects of not being prepared to operate as ecommerce businesses.

What is the lesson for you? When you’re investing, it’s wise to work with a fund manager who can pick the winners and sell the losers. Your fund should be diversified enough to adjust to market shocks; a fund manager will substitute the losers for winners to ensure your fund remains on a positive trajectory.

Overall economic impact of the coronavirus pandemic

What was originally perceived as a containable health crisis has morphed into a financial liquidity challenge. Debtors are struggling to meet their commitments and investors are selling assets to meet various demands on their finances. As a result, a global recession is inevitable.

We are now facing two consecutive quarters of negative GDP with markets trying to understand the depth and length of the downturn.

What makes this downturn unusual is that dividends could be postponed or cut in line with profits. This is potentially a bigger problem in the UK where companies have historically been generous with their pay-outs but have also largely maintained them in a downturn.

It’s clear that economic activity – and life in general – has been temporarily put on hold because of social distancing measures. However, it’s not until we are on the other side of the current situation that we will really know the true impact, on society and the economy.

The possible shape of recovery

No one can predict the future. All we can do is focus on the range of possibilities, including:

- V-shape – this is possible because we are certainly in a recession. However, a recovery similar to what we saw after the September 2001 terror attacks is unlikely. At that time, the buyback in equities was euphoric. Something similar is unlikely now because of the number of countries in recession at the same time.

- W shape – there has been a rally in the market but there could be a double dip. If that happens, it could be an opportunity for those who missed the first rally but there are no guarantees.

- L shape – this could become a reality if we can no longer travel or tourism is essentially stopped because of border restrictions and a second wave of infections. If this happens, economies will recover slowly, possibly not before the end of 2021.

- U shape – we’ve already seen the economy experience a sharp decline, which runs deep across the world. This is a not a 6, 9 or even 12-month recovery scenario as the current recession runs deep across the world.

- Swoosh – if this happens, it’s also likely to see economies recover towards the end of 2021, especially in the UK because of the uncertainty surrounding a delay with Brexit.

Regardless of the exact recovery, it will be long-term. The good news is that the current recession is event driven as opposed to a systematic recession.

What does this mean for you? Your investment decisions will be different if you are wanting to drawdown on your pension now or if your investments are reaching maturity.

A vaccine is key to economic recovery

Science, rather than fiscal stimulus, will be the key to recovery. Fortunately, work on developing a vaccine is being fast-tracked although when exactly it will be ready is not yet known. Hence the importance of ‘flattening the curve’ in the short term.

How to review your portfolio’s performance

Understandably, some clients want to jump ship to avoid feeling future pain. However, what happens when you miss the best performing days? As you can see below, if you miss the best five days during a bull market, you could lose thousands:

Quilter Investors as at 31 December 2019. Based on an initial investment of £10,000 into the MSCI World Index over the period 31 December 1999 to 31 December 2019. Gross return in pounds sterling. The information provided is for illustrative purposes only and doesn’t represent the past performance of any particular investment. It is not possible to invest directly into the MSCI World Index.

Now the markets have rallied there is the potential of missing the best days. Our advice, therefore, is to not rush to sell at the bottom of the market.

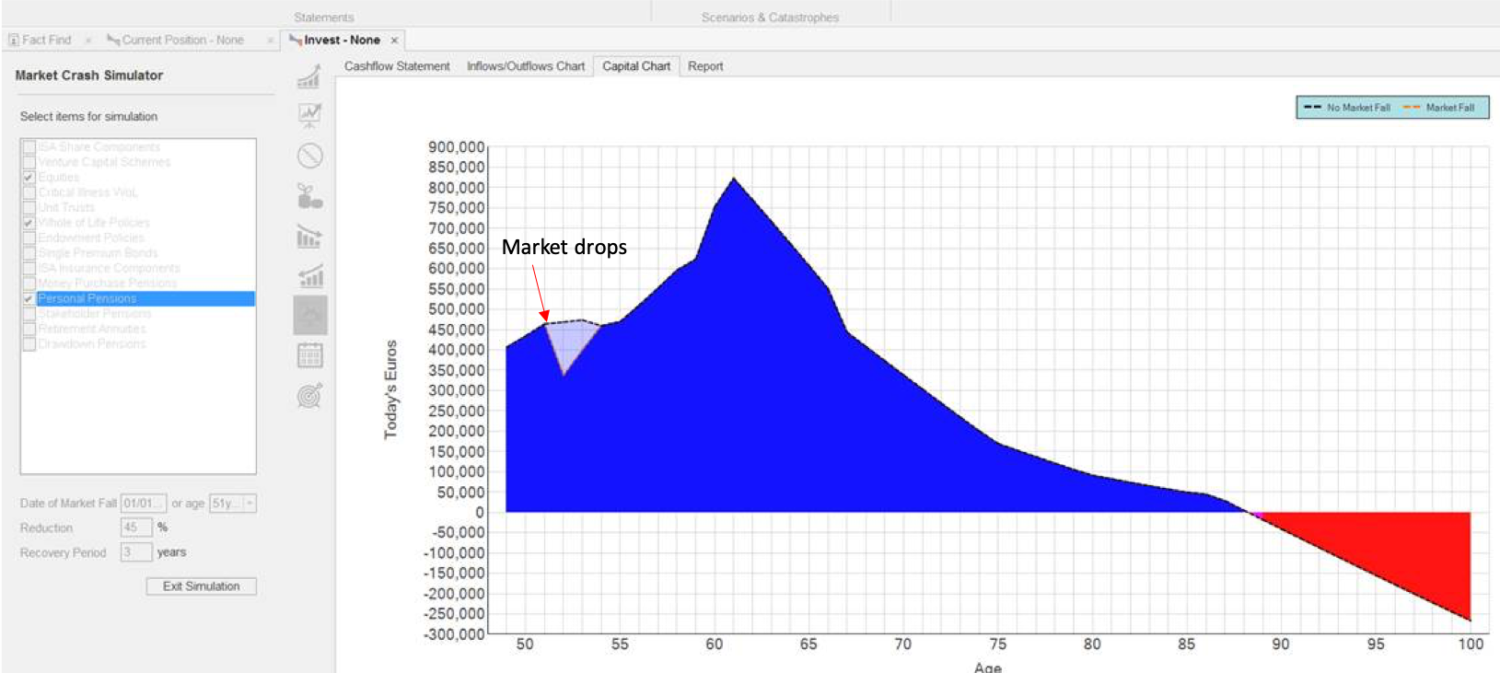

Lifestyle Financial Planning further shows what happens to the total amount of investments if the market takes, for example, three years to recover from a 30% drop in equity value.

Over time, it recovers, and total performance is maintained.

Regular savings and cost averaging

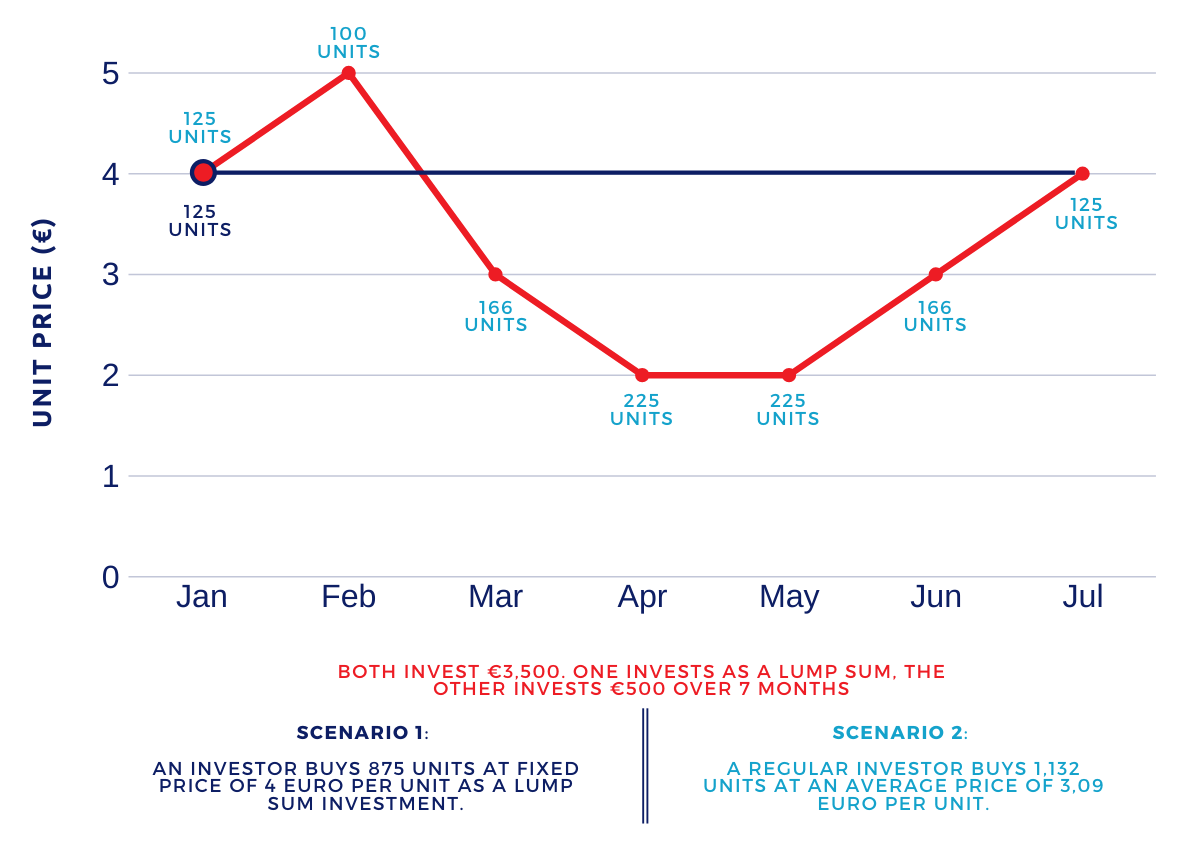

We have many clients who are savers. They save month in, month out, to achieve their goals. Just like investors, savers can also become concerned when hearing about disarray in the markets. However, dramatic dips in the markets can benefit savers as well. Here’s how:

While the above example shows a savings strategy for only seven months, it gives the ultimate reassurance to savers about what can happen when you don’t race to sell when the market dips.

By continuing to invest and save through a falling market, and commit to your regular savings and investments, you can end up with more than when you started. This is a significant benefit of cost averaging. Following this strategy also stops you from having to time the market.

Time to buy or sell?

What we know for sure is that markets are constantly changing and the only time to invest is all the time, even during a global pandemic.

We also know the most important thing for you is to have a diversified portfolio that is consistently managed by a fund manager.

In summary, resist the temptation to make knee-jerk reactions and always seek financial advice.

Watch the webinar replay

If you couldn’t make it to the live webinar, watch the recording below: